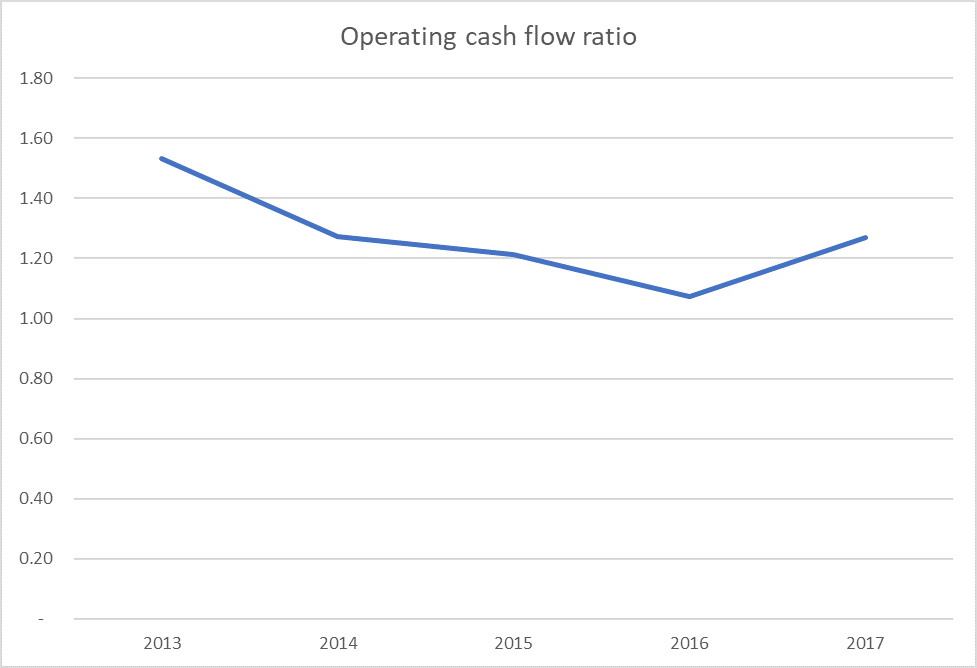

operating cash flow ratio industry average

In working capital 1222 483 940 2641 2710. The formula for the operating cycle basically represents a cash flow calculation that intends to determine the time taken by a company to invest in inventory and other similar resource inputs and then return to the companys cash account.

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Total available liquidity 1 of 11 billion including 5449 million.

. Price History Performance. Get help with your Cash flow homework. Cash flow as opposed to income is sometimes a better indicator of liquidity since bills are typically paid with cash.

Financial ratio analysis compares relationships between financial statement accounts to identify the strengths and weaknesses of a company. Operating cash flow used by. The current ratio is an essential financial matric that helps to understand the liquidity structure of the business.

One financial ratio viewed in isolation will not tell you a great deal about a business. Liquidity solvency efficiency profitability equity market prospects investment leverage and coverage. After adjusting for non-cash transactions it adds subtracts.

In other words the operating cycle The Operating Cycle The operating cycle of a company also known as the cash cycle is an activity ratio that. Lets assume that the average 30-day stock price of company ABC is 20within the last 12 months 1 million of cash flow was generated and the. The Average Current Ratio for Retail Industry.

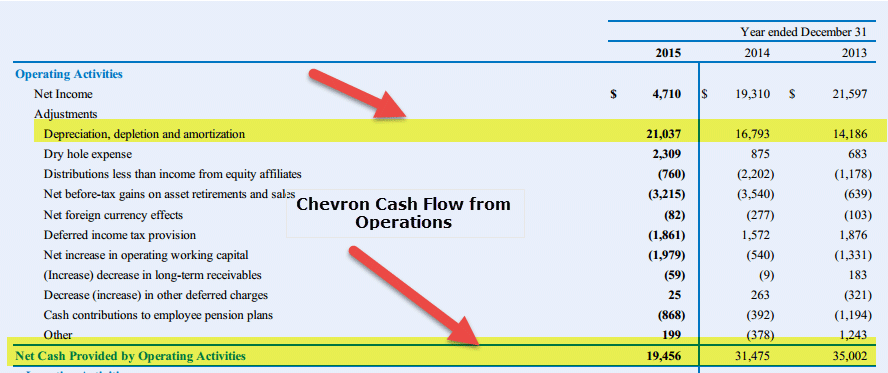

Operating cash flow before non-cash changes. Generated 293 million in operating cash flow before changes in working capital 1. See All Risk Checks.

It is the most important part of cashflow statement which presents cash flows related with all operating activities of a business. In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and expenditures on fixed assets known as capital expenditures. Calculate the price to cash.

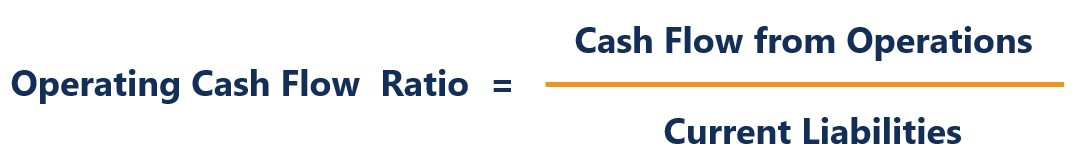

Operating Cash Flow Ratio The operating cash flow ratio meas-ures how well cash flow generated from operations covers current liabilities. Large one-off items impacting financial results. Conversely this ratio shows what proportion of revenues is.

PG HA ROT 40-50 Defensive interval Cash burn rate 365 X Quick ratio numerator Projected expenditures COGS Other operating expenses except depreciation Conservative view of firms liquidity. Unstable dividend track record. This may also indicate problems in working capital management.

An indirect cash flow statement shows the cash flow from operating activities beginning with net income loss changes in working capital balances by account type and add-backs for non-cash expenses and net cash flows from operating activities. Retail is an industry that is expected to generate cash on a day-to-day basis and its easy for lenders to get. If the current ratio is too high much more than 2 then the company may not be using its current assets or its short-term financing facilities efficiently.

Its especially helpful for the businesses lenders that assessability of the business to repay their dues. Ltd manufacture plastic boxes company has its net income of 45000 total non-cash expenses of the company are 10000 and changes in working capital is 2000. Net loss attributable to equity holders of 053 per share and adjusted net earnings attributable to equity holders 1 of 006 per share.

Operating Cash FlowNet Sales. Newer companies may trade at higher ratios due to their growth potential. Access the answers to hundreds of Cash flow questions that are explained in a way thats easy for you to understand.

Financial ratios are usually split into seven main categories. Debt is not well covered by operating cash flow. Cash Flow from Operations Formula Example 1.

CFO ratio CFO Average current liabilities Ability to repay current liabilities from operations Benchmark. You save a huge amount of time by using these templates. Cash flow templates also help you in listing your finances in a very orderly manner which can be extremely useful for future references.

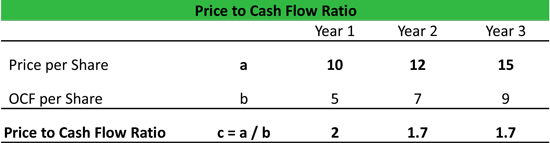

These figures also depend on their industry and maturity in the market. Cash Flow from Operating Activity. Historical Datasets Ratios for Stocks.

April 3 2021. The key with using financial ratios is to chose the ratios which are most critical to your business decide on the formula to use which should be the same as that used by comparable businesses in your industry and consistently monitor the ratio over time relative to other ratios you have. A low current ratio can often be supported by a strong operating cash flow.

Liquidity ratios indicate how well a company is able to pay off its outstanding short-term debts. The operating activities section is followed by cash flow line items and net cash flow totals in the investing activities section and. Average Operating EBIT Margin by Industry 20 Years of Data SP 500 Andrew Sather.

The operating margin ratio also known as the operating profit margin is a profitability ratio that measures what percentage of total revenues is made up by operating income. Cash Flow Questions and Answers. In other words the operating margin ratio demonstrates how much revenues are left over after all the variable or operating costs have been paid.

Compares currently available quick sources of cash with. This ratio which is expressed as a percentage of a companys net operating cash flow to its net sales or revenue from the. Price-to-cash-flow ratio Share price operating cash flow outstanding shares A low PCF ratio could indicate the organization is undervalued and a high ratio may mean its overvalued.

The operating cash flow ratio can gauge liquidity in the short-term. Cash flow templates can find use in all kinds of businesses. If you are looking to make a budget then you can make use of Excel budget templates.

A company named Neno Plastic Pvt. A financial ratio or accounting ratio is a relative magnitude of two selected numerical values taken from an enterprises financial statementsOften used in accounting there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. Operating margin is probably the most useful profitability ratio because its much less volatile than net margin but includes all operating expenses to run a business which gross margin doesnt.

Liquidity Ratio Operating Cash Flow Ratio. Mine-site free cash flow 1 of 1338 million and adjusted EBITDA 1 of 3557 million. All other things being equal creditors consider a high current ratio to be better.

It is that portion of cash flow that can be extracted from a company and distributed to creditors and securities holders without causing issues in its. Financial ratios may be used by managers within a firm by current and potential. While presenting using indirect method it starts with the net income of the business makes adjustments for non-cash transactions like depreciation.

For example your operating cash flow ratio indicates the number of times that you can pay off your current debts with cash generated from your business.

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Price To Cash Flow Ratio Formula Example Calculation Analysis

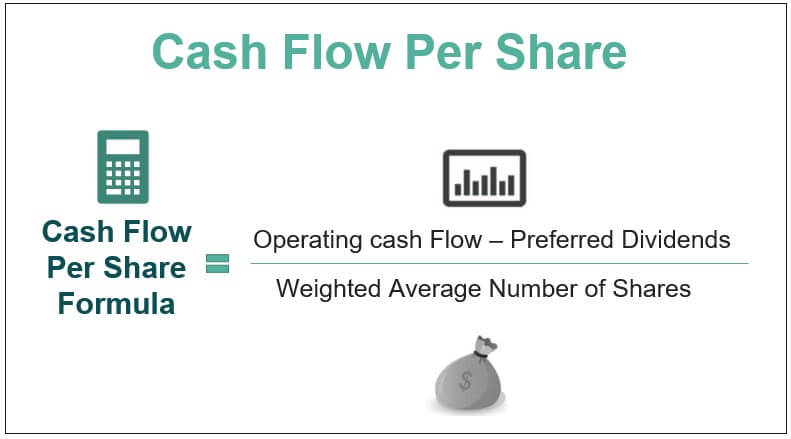

Cash Flow Per Share Formula Example How To Calculate

Operating Cash Flow Ratio Definition Formula Example

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

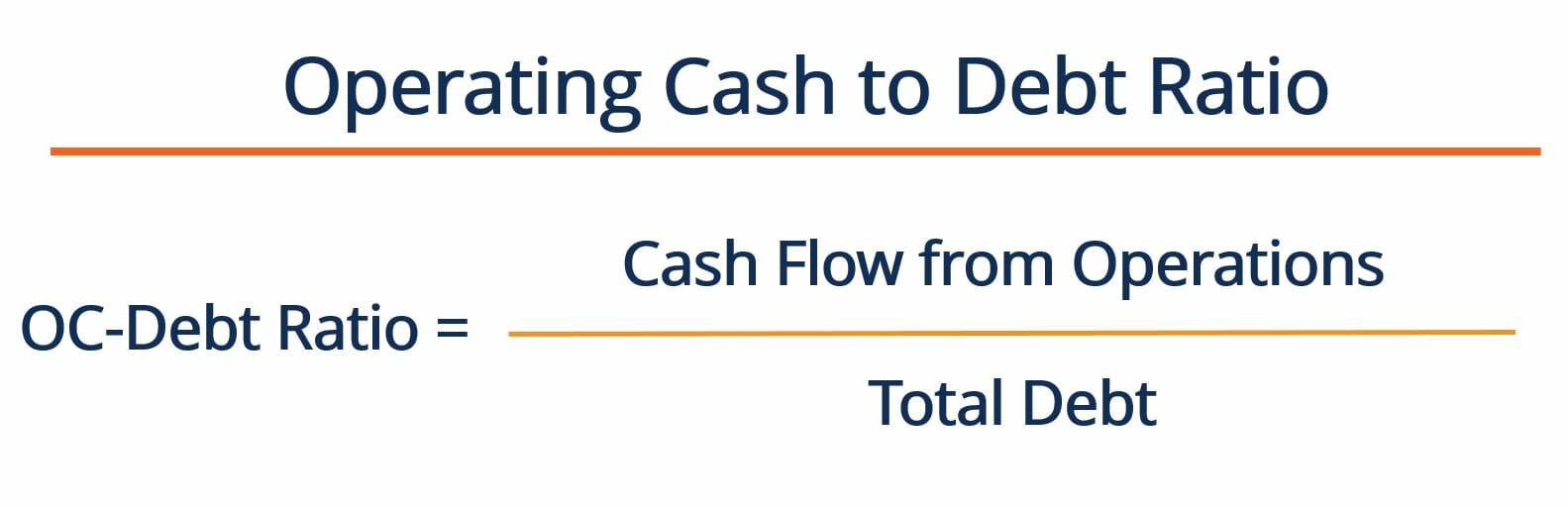

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Analyzing Cash Flow Information Accounting For Managers